Discover fresh perspectives and research insights from LBS

Think at London Business School: fresh ideas and opinions from LBS faculty and other experts direct to your inbox

Sign upPlease enter a keyword and click the arrow to search the site

Or explore one of the areas below

You have 30,000 days on Earth. Here’s how to decide how to spend yours

When I finished my MBA at London Business School back in 2007, I found myself in a world strikingly similar to the one graduates face today. 2007 was a moment of jolting economic uncertainty. True, Lehman Brothers had yet to collapse (that was September 2008), but the global financial crisis was already brewing – the signs were there, especially in the US subprime mortgage market. The S&P 500 would go on to lose over half its value between October 2007 and March 2009. Today, graduates are confronted by a similar type of financial uncertainty – in addition to surging geopolitical instability, persistent inflation and the onrush of AI that is already reshaping the world of work.

Back in 2007, the iPhone had just been launched, bringing with it the start of the mobile and social media revolution. In 2025, graduates are attempting to decode what Generative AI will mean for their careers and the skills they’ll need to succeed. Globalization and the rise of the Internet economy meant the job market in 2007 was changing rapidly, with traditional, linear career paths slowly being replaced by ‘zigzag’ careers and the need for continuous learning. If anything, today's job market is even less predictable. From the gig economy, remote and hybrid work, to portfolio careers, project-based work and side hustles, there is no longer a single definition of work, which is disorientating yet exciting for ambitious graduates.

And that’s pretty much where the similarities end. Today’s graduates face a world that is going through technological and economic upheaval that is, if anything, accelerating, with global challenges – including political polarization, multifaceted global conflicts as well as climate change – that are arguably more complex than at any point in history.

I opted to do an MBA because I wanted to expand the peripheral vision of my career – and it ultimately became the catalyst for me moving to Silicon Valley, where I would go on to be part of the early days at Uber and Dropbox, before returning to Europe and joining Balderton Capital, and later co-founding my own venture capital firm. Back in 2007, the job market appeared in dire straits, and I wish I’d had someone to give me practical and clear-eyed career advice at the time. For those of you deciding what to do next, I want to be that person for you today.

“There is no longer a single definition of work, which is disorientating yet exciting for ambitious graduates”

Thinking strategically about your career from the start can save you years of trial and error, especially in the world of fast-growing startups which have always been at the heart of my journey. It’s a path that has taken me from being an operator and entrepreneur to the boardroom, before evolving into an angel investor, and ultimately a venture capitalist. Here are my ten key takeaways from those whirlwind decades.

Never fly blind – always be aware of the macro trends that are shaping the world around you and therefore the job market. Currently there are four growth areas. The first and most significant is AI, specifically the rise of Generative AI, which is changing the world of work and jobs arguably at a faster rate than any technology in history. What does that mean for you? AI literacy will be non-negotiable. Make familiarizing yourself with the major GenAI tools out there, and understanding the structure of the wider ecosystem, your top priority. Every industry will require AI-related skills. Stay informed, experiment, and be ready to adapt.

Other key areas to deep dive within include Sustainability & Climate – while VCs are investing less in that field versus pre-2021, it is still a high-demand area and will be a major driver of future jobs and opportunity. Go where the action is – look for emerging innovation hubs and red-hot sectors which correlate with global trends. For example, geopolitical turbulence and global rearmament is seeing multiple billions being poured into defense and defense-tech. The same goes for deeptech and future industries such as quantum computing – an area I’m really excited about – space-tech, drug discovery and biohacking. The overarching theme, however, is AI, and I predict we will soon see the first company created by a single founder with no employees cross the billion-dollar valuation threshold, simply using AI APIs. The boundaries are stretching.

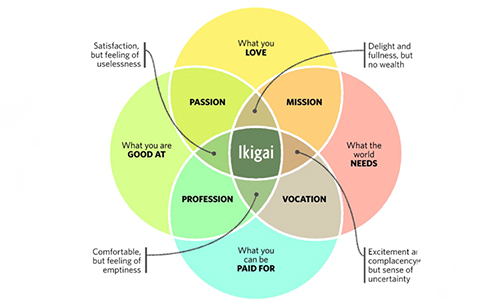

Ikigai is a Japanese idea meaning ‘Reason for being’. Your career should align with four key factors: What you love; What you’re good at; What the world needs; and What you can be paid for. When you find this balance, work feels meaningful, and success flows naturally. Now is the moment to take a step back and go through these exercises. Really get to know yourself. It’ll help you avoid certain landmines later. (You can explore Ikigai further here and here.).

Similarly, use strategic business principles to develop a life strategy. You have 30,000 days on Earth, give or take, and you’ll want to spend them wisely. And if you drill down further – as I’ve argued before – you really only have about the span of two Olympic Games cycles to establish yourself. That’s eight years to really understand your values, interests and ambition – and what you excel at – to peak perform during those two cycles.

One of the best hacks I’ve come across for doing that is Strategize Your life™ devised by Rainer Strack, Senior Partner Emeritus at Boston Consulting Group. Rainer adapted the model for strategic thinking that they use with corporate clients to help people design better futures for themselves. The model involves seven steps with each guided by a question: How do I define a great life? What is my life purpose? What is my life vision? How do I assess my life portfolio? What can I learn from benchmarks? What portfolio choices can I make? How can I ensure a successful, sustained life change? As Rainer says this isn’t a “golden path to happiness or life satisfaction”, but a way to figure out your life strategy. (Learn more about it here.)

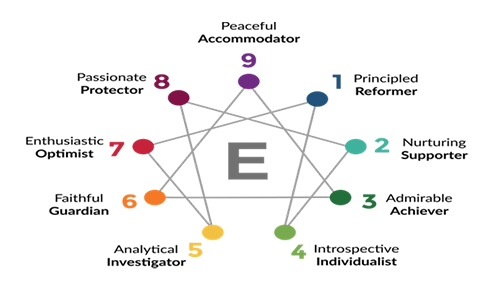

The Enneagram is a personality test (see image above) which is incredibly powerful for building an uncannily accurate profile of how you think, feel and act – the results feel like they come from someone who has known you your whole life, It helps you understand what your beliefs are, your values, goals and what you really want (aka your personal North Star) – and that level of self-awareness is key for making more conscious choices about our actions, which direction to go in etc. It’s particularly useful when you’re thinking about the culture of a firm you’re considering joining – whether you’ll fit in there, how you’ll manage your relationships and so on. This stuff really matters, so I urge you to take it.

“You really only have about the span of two Olympic Games cycles to establish yourself”

When you start your job/opportunity search, you need to be clear about your appetite for risk. What is your personality type (see #4)? With, for example, debts to pay off from your studies, are you someone who may be more comfortable with the stability, salary and benefits a large corporation can offer – not to mention the ability to climb the ladder? Or are you a risk-taker, comfortable with the fluidity and uncertainty that comes with founding or joining a startup, and taking a low salary alongside equity with the potential for enormous upside?

Understanding your tolerance for risk is fundamental for helping you navigate career decisions – whether that’s jumping on board an early-stage company, joining a Big Tech or legacy tech firm or indeed breaking into venture capital. The last thing you want is to be a year into your new journey and realize you made the wrong choice for reasons you could have predicted by doing your homework, ahead of taking the leap.

To minimize risk, I would go as far as to say that if you want to found your own startup, first go and join a company with momentum – and learn from them. However, if we start with the premise that you want to work for a technology company (venture-backed startup, scale-up or established corporate), begin by mapping out the tech landscape using a worksheet: on the x-axis you’ll cover categories such as ‘Geography’ (i.e. where a company’s based), ‘Industry sector’, ‘Upside/risk’ (i.e. your risk appetite), ‘Salary & stock’, ‘Company size’, ‘Culture’ (I always think of this as the company’s ‘blood type’ – either it matches with yours or it doesn’t), ‘Brand’ (joining a company with a strong brand will always open doors for you), ‘Momentum’, ‘Funding stage’ and so on, including how you would rate a company against your personal North Star. Then along the y-axis list the top VCs (ideally you want to join a company with strong investors) and pick the portfolio companies that are performing well that interest you – then cross-reference them with each category.

Now take that process a step further and write an investment memo (or offering memo) for, say, the three companies you most want to work for in the form of a pitch deck that provides a comprehensive overview and all the key metrics as if written for investors. Approach it as if you were making the case for investing your own money into this company. That will help you understand its value proposition and market position, and ensure you stand out as a candidate. When I invest in early-stage companies, I broadly look across four key themes: ‘Team’, ‘Product’, ‘Monetization’ and ‘Timing’. You can read more about that here. There is no one-size-fits-all approach, however, and typically VCs and angels have different methodologies. The one thing everyone can agree on though is that luck plays a big part in success.

VC is often seen as something you get into only if you want to become an investor. But there are actually three types of jobs in VC. The first and most obvious is indeed investing (see the image above), with roles ranging from General Partner to an entry-level Analyst. Next there’s the Platform team, covering Talent, Marketing, Sales & Business Development and so on. Finally, Operations encompasses fields such as Finance, Legal and Communications. Working in VC can mean working in any of them, and even if you want to become an investor, your entry point doesn’t need to be an investing role. Whether it’s an operational, finance, or a portfolio support role, getting your foot in the door is what matters. Once inside, opportunities will open up. If you do decide that nothing will stop you from becoming an investor, a great way to break in is to get experience as an angel investor or as a scout, build your contacts among startups, and bring VCs deal flow.

Once again, my strong suggestion here is that you map out the VC universe, detailing the key firms, partner profiles, where they are located, the categories they specialize in, their breakout portfolio companies, their own fund raises, their exits, etc. And then do a deep dive into what people – especially founders – say about them in media coverage and on social media, review sites such as Glassdoor, and then rate all of these against your personal North Star. Once you’ve narrowed your choices down to, say, half a dozen firms then track down alumni on LinkedIn and start building relationships. Read more from my former Partner at Balderton, Suranga Chandratillake here.

Arguably a lot of success comes from specialization and branding – pick an important niche that you love, focus on it and aim to be the best in that area. However, just as we often refer to the TAM (total addressable market) in venture capital, ensure your niche is large. This will always set you apart in competitive industries and focus your story and reputation. In my case, I became obsessed with large impact deal-making and business development – especially new types of deals that could be measured and patented. Filing patents always made me feel like a digital explorer. There are invariably jobs going at VC firms and technology companies, even if they are not advertised publicly. Being among the best in your field is your fast-track in.

If a company doesn’t align with your goals or values, or it isn’t taking you in the direction you want to go in – or you just feel stuck – do not hesitate to leave. Remember: you have two Olympic cycles to make an impact. Staying too long in the wrong environment or role can seriously hamper your career and personal growth, and it potentially hurts your employer. As Steve Jobs said in his 2005 Stanford commencement speech: “For the past 33 years, I have looked in the mirror every morning and asked myself: ‘If today were the last day of my life, would I want to do what I am about to do today?’ And whenever the answer has been ‘No’ for too many days in a row, I know I need to change something.”

However, this isn’t about moving on as soon as you experience a bump or two in the road. Always remember we grow most facing adversity. Make sure you are patient and prioritize the right things. For example, don’t be dazzled by a job title, instead prioritize your co-workers, the value of the work you do and results you achieve, as a team. Remember: your colleagues are your strongest advocates. Similarly, always keep in mind what’s best for the company – which should be your North Star on the job. If you find that on too many occasions your personal North Star is not aligned with what’s best for your employer, then make adjustments or move on.

Many of the most successful entrepreneurs, investors and business leaders have faced multiple setbacks along the way. Failure, per se, doesn’t matter. Learning from your mistakes, rebounding and iterating quickly does. In a world of increasing technological change and shifting career paths, resilience is one of the most valuable skills you can develop. So don’t let fear of failure prevent you from taking risks, exploring new opportunities or pushing yourself far beyond your comfort zone.

I learned this firsthand when I was laid off from VoiceSignal. At the time, I didn’t understand why it had happened to me. It was disorienting, and I was left questioning my next steps. However, that unexpected event set off a chain reaction that would shape the rest of my career. It led me to join Dropbox, which then opened the door to joining Uber, and so on…

What seemed like a setback at the time propelled me on a path towards something even bigger. Later, I discovered that VoiceSignal had been mired in a lawsuit with Google, and that was the real reason for my layoff – something entirely out of my control. So take the big swings. If you fail, fail fast, learn, and keep going. Your biggest breakthroughs often come from your biggest challenges.

However always remember, a meal is only as good as the last bite. First impressions land the interview, but lasting impressions land your next dream job.

Lars Fjeldsoe-Nielsen is an alumnus of London Business School and a General Partner of Balderton Capital. He works closely with the LBS Career Centre on numerous projects including curriculum advisory work and giving guest presentations to share his experiences to students looking to break into the tech and VC scene. Lars’ short bio is here.

Discover fresh perspectives and research insights from LBS

Think at London Business School: fresh ideas and opinions from LBS faculty and other experts direct to your inbox

Sign up